Alright, so let’s talk IOC — Indian Oil Corporation. One of those classic “your uncle probably bought this stock back in 2003” kind of companies. It’s been around forever, it’s in every Indian’s life in some way (hello, LPG cylinder deliveries), and it’s one of those PSU (Public Sector Undertaking) stocks that people either blindly trust or totally avoid. There’s rarely an in-between.

Now, coming to the ioc share price target 2025, let’s break it down without the fancy jargon.

So… what’s IOC been up to?

IOC’s business model is basically oil refining, pipeline transport, and selling petrol, diesel, LPG and other fuels. But lately, it’s been trying to get a little fancy — investing in clean energy, hydrogen, ethanol-blended fuels, EV charging infra, all that green-ish stuff.

Now, honestly, PSU stocks don’t move like your favorite midcap tech stock that gains 20% in a week because some influencer tweeted about it. These are slow, steady (and sometimes boring) giants. IOC is no different.

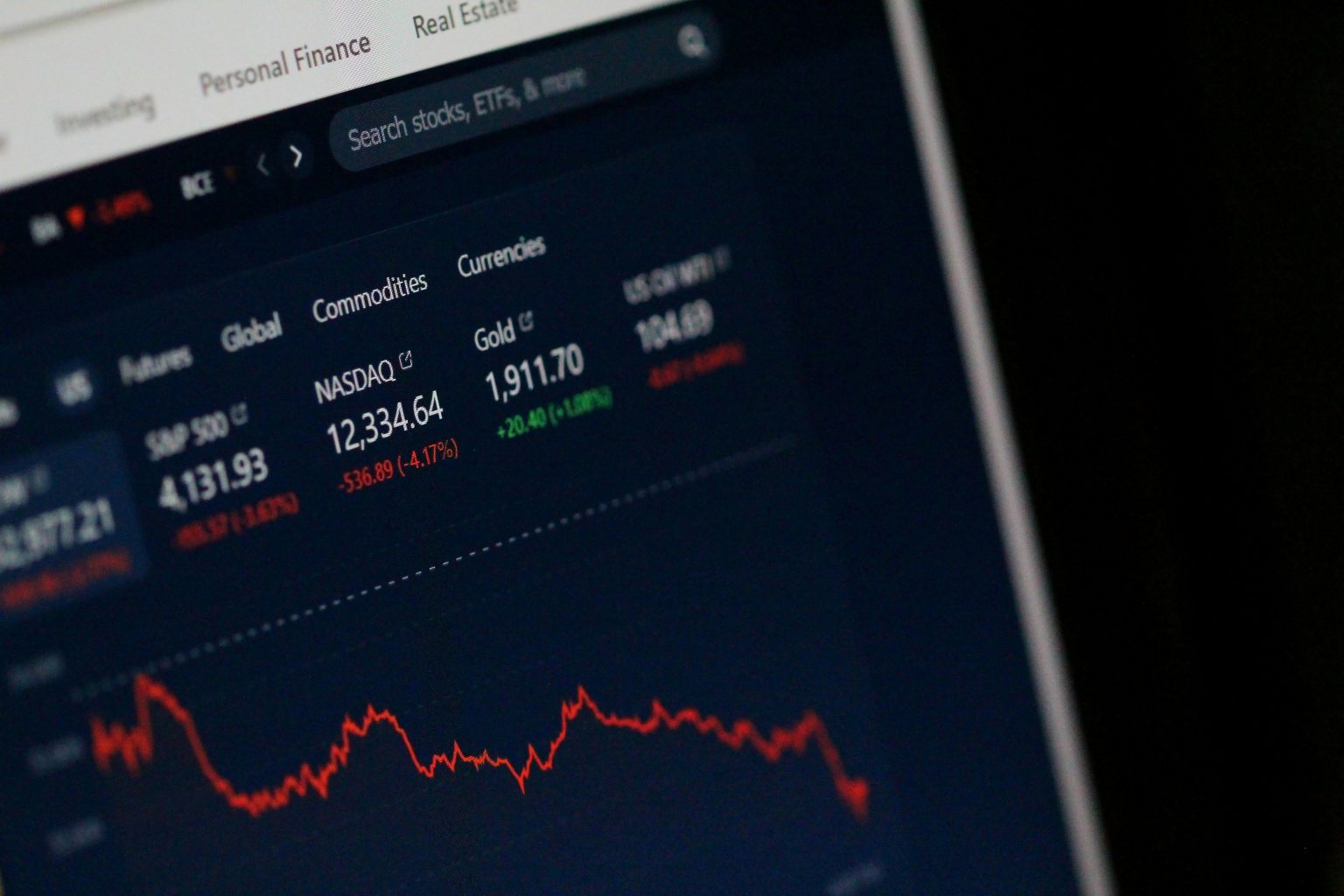

But don’t underestimate it either. Crude oil prices, global tensions, government subsidies, election policies — all these things can throw IOC’s stock price around like a cricket ball in IPL.

Let’s talk numbers (because that’s why you’re here, right?)

As of mid-2024, IOC was trading somewhere around ₹160-₹180. It had its ups and downs, of course. A few quarters ago, its margins took a hit when global crude prices went nuts, and the government told them to keep prices stable (thanks, elections ).

But post-elections, the dust is settling, and IOC’s refining margins are slowly recovering. Add to that:

Dividend payouts (yep, they pay well — usually 8-10% yield),

Massive capex plans in hydrogen and green fuels,

And a stabilizing oil market…

…and the outlook isn’t too shabby.

My totally human (and slightly cautious) 2025 Target?

Most analysts are dropping numbers like ₹220 to ₹250 for IOC in 2025. I’d say that’s realistic if the global oil market doesn’t act up and India’s economy keeps humming along.

If oil prices stay under control and IOC nails its expansion into alternative fuels, don’t be shocked if it tries to push even beyond ₹250.

But — and this is a big but — if crude shoots up to $100+ again or the govt puts a lid on fuel prices for too long, IOC’s margins could feel the heat, and it might just chill around ₹180-₹200.

TL;DR (because we all love those):

2025 Share Price Target: ₹220 to ₹250 (base case), maybe ₹260+ if things go really well

Dividend? Still juicy

Risks: Oil price volatility, government price control, PSU drama

Opportunities: Clean energy push, EV infra, hydrogen bets

Final thoughts (a.k.a me pretending I’m an expert)

If you’re looking for a “double in 6 months” kind of stock, IOC isn’t your jam. But if you like solid, dividend-paying, semi-defensive plays with long-term potential, IOC might still deserve a spot in your portfolio.

Also, watching IOC’s moves in EV charging and hydrogen space is kind of like watching a boomer trying TikTok — slow, experimental, but potentially game-changing if they get it right.

Invest wisely — and don’t forget, even petrol smells different when the markets are in bull mode.